Obama and Geithner’s plan for bank rescue sent the markets into euphoria. Well it warmed their hearts to see the state subsidizing the same kind of hedge fund profiteering. Was that excitement a scary sign that the markets can see a team winking their way back to the bubble economy? Paul Krugman thinks so.

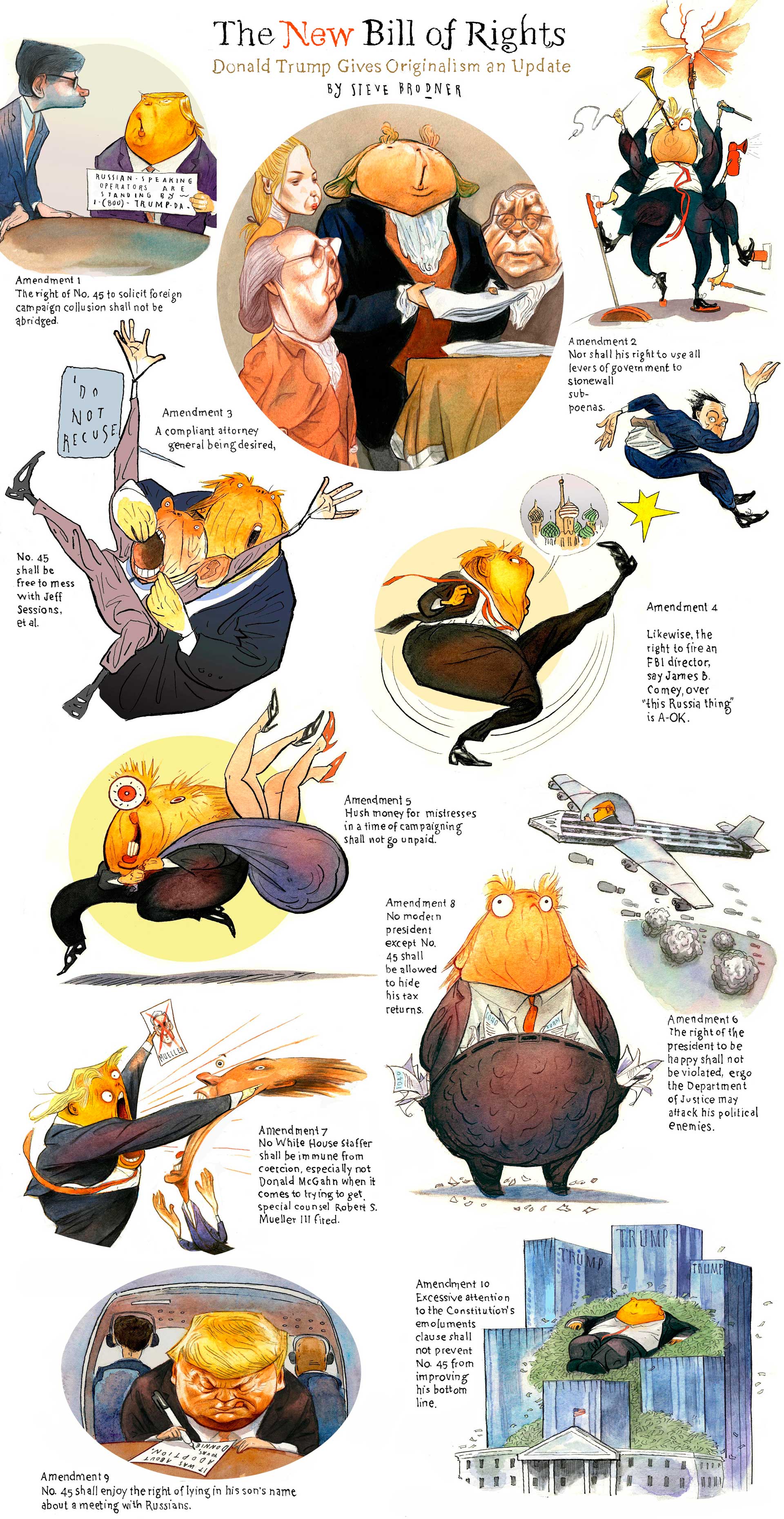

“Tim Geithner, the Treasury secretary, has persuaded President Obama to recycle Bush administration policy — specifically, the “cash for trash” plan proposed, then abandoned, six months ago by then-Treasury Secretary Henry Paulson.

This is more than disappointing. In fact, it fills me with a sense of despair.

After all, we’ve just been through the firestorm over the A.I.G. bonuses, during which administration officials claimed that they knew nothing, couldn’t do anything, and anyway it was someone else’s fault. Meanwhile, the administration has failed to quell the public’s doubts about what banks are doing with taxpayer money.

And now Mr. Obama has apparently settled on a financial plan that, in essence, assumes that banks are fundamentally sound and that bankers know what they’re doing.

It’s as if the president were determined to confirm the growing perception that he and his economic team are out of touch, that their economic vision is clouded by excessively close ties to Wall Street. And by the time Mr. Obama realizes that he needs to change course, his political capital may be gone.”

The plan to incentivise investors to handle the toxic waste in the banks in question puts the taxpayers at a disadvantage, risks huge amounts of money with a sketchy shot at recouping it. No thought of anything that would restructure the way things are done, get us into these banks and really get the straight scoop on what they’ve been doing. Instead it looks like a continuation of more of the same by Geithner and Summers, folks who helped set us up in the first place.

Naomi Prins, MotherJones.com on what could happen next:

“Here’s another possibility: The (newly purchased) assets have little or no value, because they have no incoming cash or no buyers—otherwise known as the situation we’re presently in. To this day, we don’t even have any knowledge of what exactly these assets are. The government won’t tell us because the banks won’t tell the government. And if the assets zero out, the private investors will largely be covered. The taxpayers, of course, won’t.

That plan is based on the assumption that private funds want to bother with any of this. One thing’s certain, though: The sweeter the deal the government makes to entice investors to buy assets they’d otherwise have no interest in, the worse it is for taxpayers. That’s the brand of capitalism that was at work before this crisis, and it seems to have survived the economic collapse intact.

Geithner told the Wall Street Journal last week, “Our judgment is that the best way to get through this is if we can work with the markets…We don’t want the government to assume all the risk. We want the private sector to work with us.”

The private sector helped create and spread a toxic stew of derivatives. Yet Geithner’s strategy to “fix” the financial system is to ask its riskiest, most opaque players—the companies that shirked the most in taxes and were led by the execs who made the most money during the build-up years—to buy the system’s junky assets in order “to cleanse it.” And this will come after $350 billion of capital injections and trillions of dollars of Federal Reserve loans haven’t fixed the problem.

On top of this, Geithner doesn’t think investors who participate in his program should be subject to any restrictions. No executive pay caps, no nothing. Moreover, the toxic assets to be brokered under this plan will be selected by the players that have not been able to unload them so far. It’s like going to a used car dealership and saying to the car salesman, “I’ve got $100,000 to buy whatever you have to sell me,” and expecting him to provide you with his most valuable inventory.

Of course, bank stocks rallied on this cheery news. The Dow perked up like a heroin addict about to get a fix. Why wouldn’t banks welcome the chance to participate in a government-sponsored program to clean their polluted balance sheets, where their old clients, the same ones who wouldn’t be caught dead purchasing these toxic assets, could be paid for participating?”